Overseas Investments Through LRS Jump Over 50% as Indians Chase Global Stocks and Property

India is witnessing a record surge in LRS overseas investments, with outward remittances for global stocks and real estate climbing sharply in 2025. Rising financial awareness, easier access to global markets, and growing aspirations for international assets have pushed remittances through the Liberalised Remittance Scheme (LRS) to new highs.

Latest data from the Reserve Bank of India shows that between January and September 2025, investments in overseas real estate jumped 80% to $350 million, while remittances into equity and debt instruments rose over 50% to $1.68 billion.

Combined, the two categories crossed $2 billion, marking a robust 55% increase from the same period in 2024.

Wealth managers say the trend reflects both structural economic shifts and changing investor preferences, as global diversification becomes a mainstream part of Indian financial planning.

Also Read : Rare-Earth Magnet Incentive Lifts GMDC, But India Still Lacks a True Rare-Earth Play

Rising Awareness, Slower Domestic Returns Push Investors Offshore

According to Rahul Jain, President & Head, Nuvama Wealth, rising investor education has played a major role in the surge.“As financialisation accelerates, awareness is rising. People now want international exposure purely for diversification,” he said.

Until a few years ago, domestic real estate dominated Indian household investments. Today, investors are more willing to allocate 4–5% of their portfolios toward global assets.

Muted performance in Indian equities over the last year also encouraged diversification.

Niteen Dongare, CEO & Head – GIFT City, IFSC, Anand Rathi International Ventures, noted:

“Indian equity markets did not deliver strong returns for nearly 18 months. This pushed many investors to explore global opportunities.”

While domestic markets have recovered recently, experts believe the global diversification trend is here to stay.

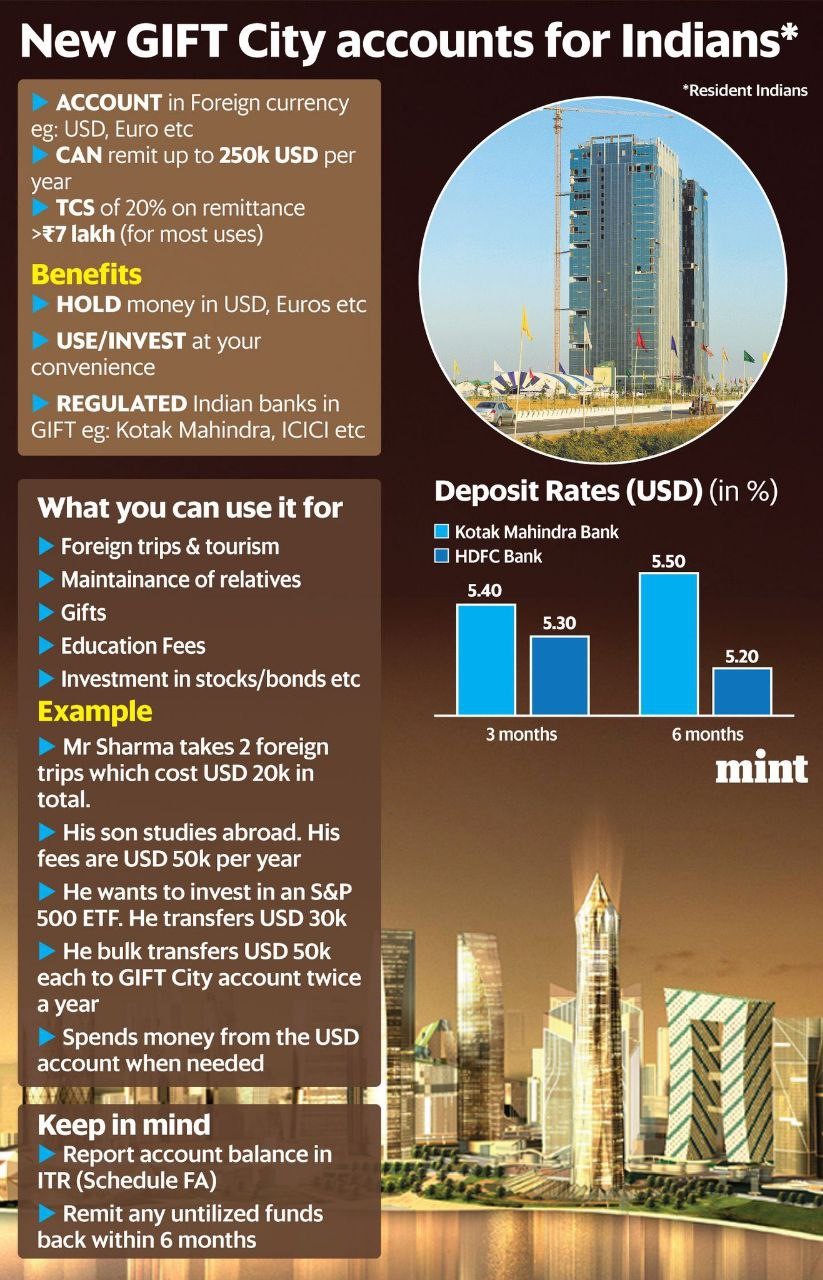

Fintech Platforms and GIFT City Add Momentum to Global Investing

The proliferation of digital investment platforms has also turbocharged LRS overseas investments.

From buying US blue-chip stocks like Apple and Microsoft to accessing global ETFs, Indian investors today trade international securities almost as easily as domestic equities.

Dongare said foreign brokerages and Indian fintech platforms have made global markets more accessible than ever.

“Platforms allow seamless access to US markets and other global economies. This convenience has expanded cross-border investment significantly.”

GIFT City has emerged as another powerful channel:

-

NSE IFSC Receipts allow trading the top 50 US stocks in demat form

-

Global access platforms use US custodians for international trades

-

Outbound AIFs, PMS, and GIFT City–based global mutual funds are gaining traction among ultra-HNIs

These products have generated 12–13% returns, according to Dongare, further boosting interest.

Dubai Property Market Dominates LRS Real Estate Outflows

Dubai has become the top destination for Indian property buyers under LRS.

Rahul Jain explained that proximity is a major advantage:

“Mumbai to Dubai is just a two-hour flight, with over a dozen daily connections. Even Tier-2 cities are well connected, making Dubai an easy choice.”

Lifestyle familiarity, a strong Indian community, and participation by Indian developers have further strengthened the market’s appeal.

Experts say Dubai’s tax-friendly environment, high rental yields, and booming luxury housing segment continue to attract affluent Indian buyers.

Education and Residency-Linked Visas Also Fuel Outward Remittances

Education-driven migration has become a major factor behind growing LRS overseas investments.

As more affluent families send children to study abroad, long-term financial planning increasingly includes moving assets overseas.

Jain noted:

“When families see their children settling abroad—whether in Singapore, the UK, the US, or Canada—global asset allocation becomes natural.”

Residency-linked investment programmes are another important driver.

Dongare pointed out that wealthy Indians increasingly use LRS for:

-

US EB-5 visa investments

-

Golden Visa schemes in Europe, the UAE, and other regions

These programmes require investments often exceeding $500,000 to $1 million, contributing significantly to outward flows.

LRS Outflows Expected to Keep Rising Into 2026

Wealth managers predict continued growth in LRS overseas investments through 2026, supported by rising global aspirations, expanding fintech access, and greater comfort with international assets.

The combination of improving domestic economic conditions and growing global integration means Indian investors are likely to maintain strong interest in global stocks, global ETFs, overseas real estate, and residency-linked investments.

With financial awareness rising and cross-border access becoming frictionless, India’s outward investment story is only at the beginning of a multi-year uptrend.