Rare-Earth Magnet Incentive Triggers GMDC Rally, but India Still Lacks a True Rare-Earth Play

A powerful policy-driven rally has swept across mineral and resource stocks this week, with GMDC rare-earth stocks among the biggest gainers, following news that the government is preparing a major incentive scheme for rare-earth permanent magnet (REPM) manufacturing. But even as the rally intensifies, analysts caution that the excitement may be running well ahead of India’s actual rare-earth capabilities.

GMDC has surged for two consecutive sessions, driven by optimism surrounding the Cabinet’s expected approval of a ₹7,300-crore REPM incentive programme. Yet, despite the euphoria, experts stress that India’s listed mining companies—including GMDC—are not positioned to benefit in any meaningful way from the rare-earth magnet value chain at present.

Also Read : FinMin Says India Is on Stable Footing and Well Positioned to Tackle Emerging Risks

Analysts Warn Current Rally Is Detached From Real Rare-Earth Fundamentals

According to veteran market expert Dipan Mehta, the enthusiasm around GMDC’s potential role in a rare-earth ecosystem is overstated. Speaking to CNBC-TV18, Mehta stated that GMDC’s long-discussed ambition to diversify from lignite and coal into higher-value minerals has not translated into any significant progress in rare-earths.

He emphasized that despite government intent and policy support, investors “cannot buy GMDC on the basis that India intends to manufacture more rare earths.” He added that India currently has no listed company offering genuine exposure to the rare-earth magnet theme, saying bluntly that there is “no play on rare earths” of meaningful scale.

The sudden spike in mineral stocks, therefore, reflects policy excitement more than business fundamentals.

India’s Rare-Earth Value Chain Faces Major Oxide Shortages

The structural gaps in India’s rare-earth ecosystem reinforce this caution. At present, only IREL (India) Limited, under the Department of Atomic Energy, is involved in mining and refining rare-earth elements into oxides. However, supply remains significantly constrained.

During recent consultations with the Ministry of Heavy Industries, IREL informed policymakers that it can supply only 500 tonnes of rare-earth oxides annually. By comparison, the proposed REPM manufacturing target of 6,000 tonnes per year would require around 1,500 tonnes of oxides—leaving a 1,000-tonne shortfall that would still need to be imported.

This large supply gap means that GMDC and other miners are not positioned to benefit from the incentive scheme, even if demand for magnets surges. The rare-earth value chain—mining, refining, alloying, and magnet fabrication—remains far from integrated in India.

Industry Leaders Flag Quality, Cost, and Testing Challenges

Industry concerns extend beyond just volume. Vivek Vikram Singh, Managing Director of Sona Comstar, has repeatedly highlighted quality and infrastructure challenges that could limit India’s magnet manufacturing progress.

He has cautioned that:

-

India’s local rare-earth material is lower grade, requiring additional refining

-

The country lacks proper testing infrastructure for magnets

-

Production quality may remain inconsistent without significant investments

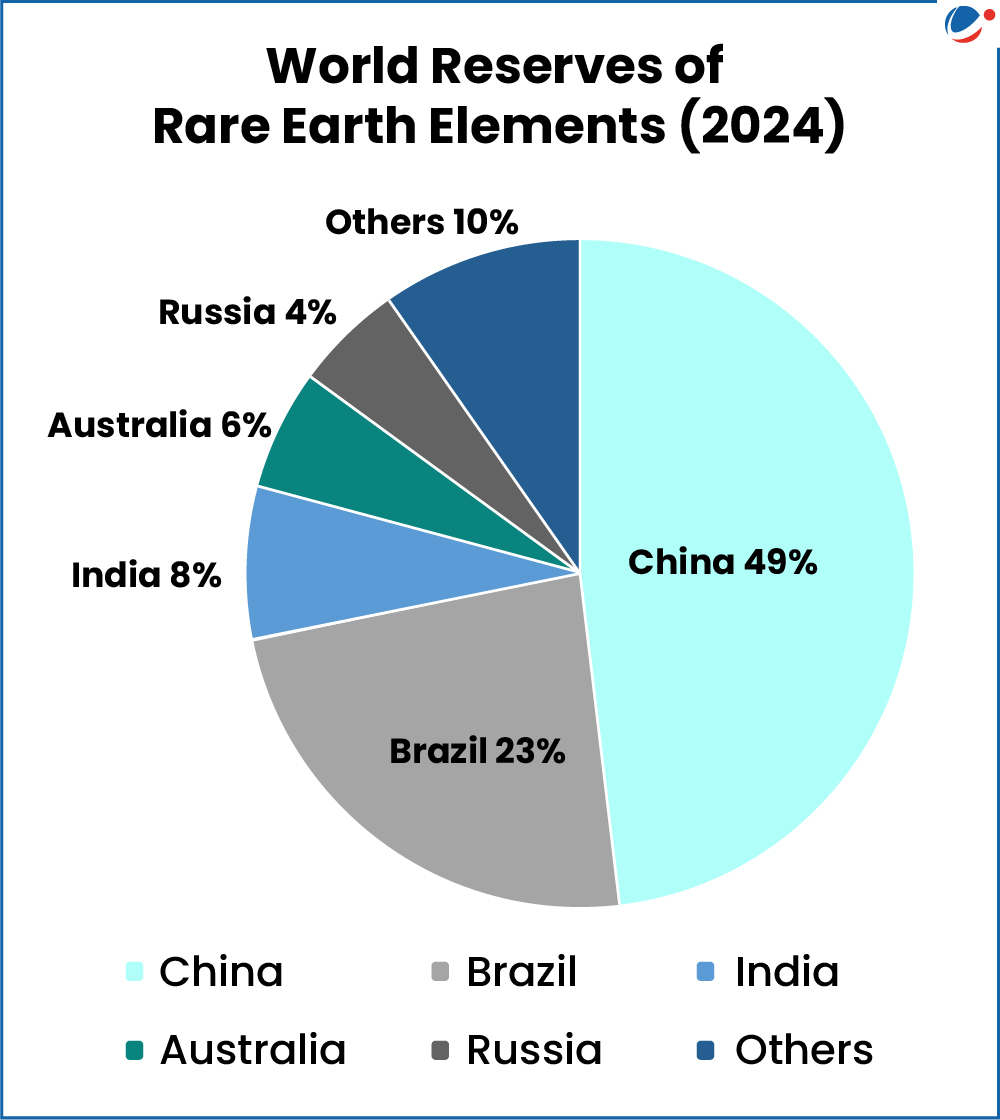

Singh also stressed the geopolitical risks lurking in the global rare-earth market. With 94% of global REPM supply concentrated in one country, he compared the situation to the semiconductor industry’s dependence on Taiwan. Sona Comstar is evaluating the incentive scheme but has not committed to investments, pending further clarity on the government’s support and cost economics.

India’s Rare-Earth Ambitions Still Years Away Despite Incentives

The new incentive scheme is expected to accelerate India’s long-term magnet manufacturing ambitions, but experts warn that policy support alone cannot fill the deep structural gaps in the ecosystem. Without adequate refining capacity, high-grade material supply, standardized quality testing, and scale, domestic magnet production is likely to remain limited for at least two to three years.

India’s rare-earth value chain—from mining to finished magnets—remains fragmented, with significant deficits in both volume and quality. While the government’s push is strategically important, the operational readiness of domestic players remains insufficient.

GMDC’s Rally Reflects Policy Optimism, Not Real Rare-Earth Exposure

For now, GMDC’s rally appears to be fueled more by sentiment than substance. The company has no active rare-earth mining operations, no oxide refining capacity, and no integrated value chain linkages with magnet manufacturers.

Until India addresses the oxide shortage, refining bottlenecks, material quality, and the absence of an end-to-end magnet manufacturing ecosystem, GMDC—and other mineral stocks—cannot be treated as true rare-earth investment plays.

The momentum in share prices remains strong, but the investable rare-earth opportunity in India is still several years away. For investors, the current enthusiasm may be worth monitoring, but fundamentals suggest caution.